18 Jul Worldwide Carrier Ethernet Market to Reach $57 Billion by 2029

By Rosemary Cochran, Principal & Co-Founder, Vertical Systems Group

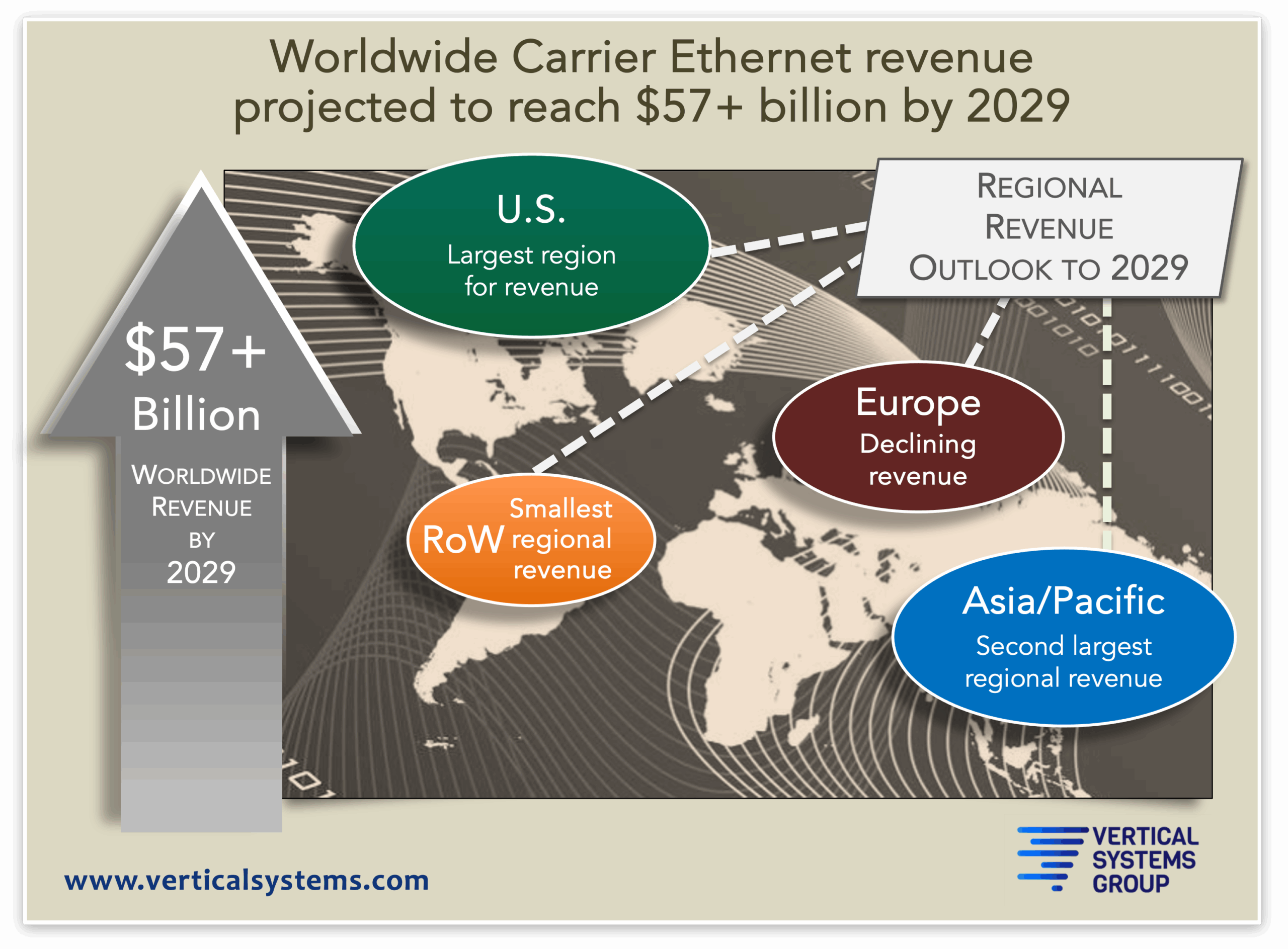

For nearly 25 years Carrier Ethernet has been a strategic data service delivered by network providers throughout the world to customers requiring high speed, high performance and highly secure connectivity. Based on Vertical’s latest forecasts across the four regional markets we track – U.S., Asia/Pacific, Europe and RoW – worldwide Ethernet revenue will reach $57+ billion by 2029.

Carrier Ethernet Revenue Outlook by Region

The worldwide Ethernet outlook to 2029 is impacted by a number of dynamics, including market maturity, the lingering impact of the global pandemic, price compression and region-specific factors. Regional forecasts for this time period vary considerably.

The U.S. is the largest regional market based on Ethernet revenue, with the highest positive CAGR between 2024 and 2029. Asia/Pacific, the second largest regional market, has a flattening revenue outlook for this projection period. Europe, the third largest regional market, has projected revenue erosion by 2027 and is the only region with a negative CAGR between 2024 and 2029. The RoW (Rest of World) region, the smallest market based on revenue, has a healthy growth outlook as well as the second highest revenue CAGR.

Five Global Ethernet Trends

-

Carrier Ethernet service providers worldwide are focusing on cybersecurity, automated service creation, faster provisioning, efficient service management and improved customer experience.

-

Surging AI requirements are expanding global demand for high gigabit speed Carrier Ethernet and Wavelength connectivity to Data Centers.

-

Customer demand is increasing for gigabit speed Ethernet services that enable secure high-speed connectivity to public and private Clouds. Dedicated Internet Access (DIA) and Ethernet Private Line services are the primary services deployed for these applications.

-

An inhibitor to higher speed Ethernet service deployments worldwide is limited accessibility to direct optical fiber facilities. Market leading Carrier Ethernet providers are addressing this challenge by actively filling fiber gaps in key country markets.

-

Many Ethernet providers throughout the world are introducing customers to NaaS (Network as a Service) which combines on-demand connectivity, application assurance, cybersecurity, and multi-cloud networking within a standards-based automated ecosystem. Mplify (formerly MEF) is actively advancing this effort.

Detailed projections for Worldwide Carrier Ethernet revenue and ports by region through 2029, plus the market share detail that powers the LEADERBOARDs are available exclusively to ENS Research Program subscribers. Contact us for more information.